Hard times predicted for UK as interest rates are cut

You probably think it isn’t worth reading but this story is more likely to impact on your quality of life than anything else on Vox Political this week.

Mark Carney and the Bank of England’s Monetary Policy Committee are cutting interest rates because they think the UK economy is about to take a pounding – mostly as a result of the decision to leave the European Union.

He said: “We took these steps because the economic outlook has changed markedly, with the largest revision to our GDP forecast since the MPC was formed almost two decades ago.

“By acting early and comprehensively, the MPC can reduce uncertainty, bolster confidence, blunt the slowdown, and support the necessary adjustments in the UK economy.”

We’d better all hope he’s right.

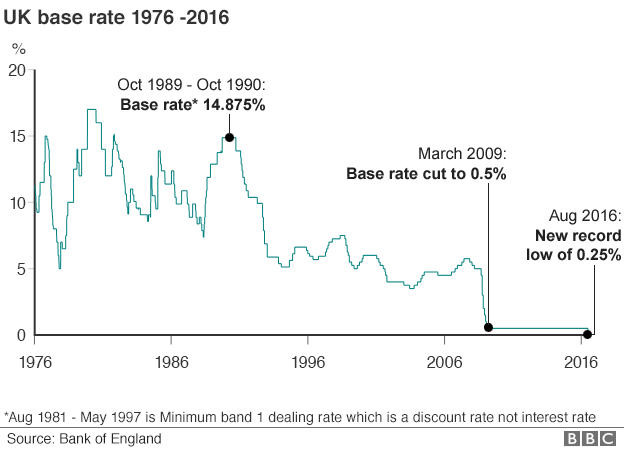

UK interest rates have been cut from 0.5% to 0.25% – a record low and the first cut since 2009.

The Bank of England has also signalled that rates could go lower if the economy worsens.

The Bank announced additional measures to stimulate the UK economy, including a £100bn scheme to force banks to pass on the low interest rate to households and businesses.

It will also buy £60bn of UK government bonds and £10bn of corporate bonds.

Governor Mark Carney said there was scope to cut the interest rate further.

Source: UK interest rates cut to 0.25% – BBC News

ADVERT

Join the Vox Political Facebook page.

If you have appreciated this article, don’t forget to share it using the buttons at the bottom of this page. Politics is about everybody – so let’s try to get everybody involved!

Vox Political needs your help!

If you want to support this site

(but don’t want to give your money to advertisers)

you can make a one-off donation here:

Buy Vox Political books so we can continue

fighting for the facts.

Health Warning: Government! is now available

in either print or eBook format here:

The first collection, Strong Words and Hard Times,

is still available in either print or eBook format here:

more pain for the prudent ones……and more risk of hyper inflation when we have to pay for all the funny money the Bank of England is printing…remember the antecedents to the 2nd world war?

There’s no chance of hyperinflation, even with the additional money the BoE will be printing to ensure the banks and the wealthy are affected as little as possible by the coming recession. It’s the fake fear that “money printing causes hyperinflation” that we’ve been led to believe since Monetarism took over sensible Keynesian economics in the 70’s and 80’s that’s resulted in most of the economic woes since then – the idea that Government spending is inflationary (not with high unemployment, it isn’t!), that the Government is a household (totally false) and that Governments spend taxpayers’ money (partially true, but not for the reasons we believe!).

If working people are ever going to see the benefits of growth again, we need to stand up to these falsehoods, not rote-learn them as the MSM would have you do.

Bill Mitchell tackles these fallacies I his blog, for starters http://bilbo.economicoutlook.net/blog/?p=9281 (Taxpayers do not pay for government spending), a worthwhile read if you want to find out more.

Hyperinflation occurred in Germany prior to WW2 because they had lost control of their productive base by the French occupation of the industrial Ruhr region and were forced to print more and more money to buy foreign currency reserves to pay off war reparations (when France and the US would not accept Marks), further driving down the value of the Mark, the lack of productive output (as a result of the French occupation) meaning they also lacked the physical goods to pay. Similar to Zimbabwe (the other “hyperinflation” bogieman of the right), when Mugabe handed previously productive farmland to his supporters (who had no interest in farming) caused a productivity crisis which triggered the hyperinflation!

Neither scenario is even remotely similar to the situation we face at this time! (however, if the UK continues to see Austerity choke off demand by reducing the number of people with sufficient earnings to buy the productive output, we may face our own kind of hyperinflation crisis, but the Government could avert this by turning on the spending taps and reverse the chronic underinvestment since 2010).

Not worth trying to save any money now!

Looks like Carney is at last doing what he’s generously paid to do instead of his, and his teams, constant poor forcasting. Just hope his actions are better than the forecasting. I guess the Government will be pleased their loan interest might be reduced.

The bubble will go pop one day, the tories will hand the country over to Labour and then say its is all there fault, we’ve been there before

If they hadn’t cut benefits so much that money would be circulating in the system and providing a stimulus to economy.

Every little helps!

“blunt the slowdown, and support the necessary adjustments in the UK economy”

Says it all really, recession is round the corner and the ‘Hard Working Families’ will have to pay for it. So what’s changed, they are going to do the ‘Right’ thing again.