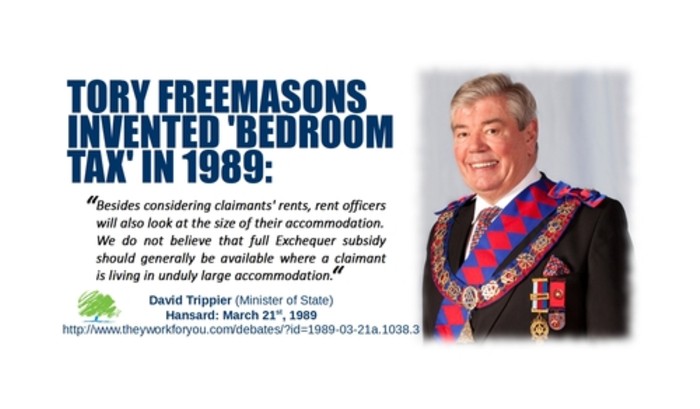

The Bedroom Tax was devised by Tories in the 1980s – NOT by Labour

The Bedroom Tax was invented by Conservatives in 1989, according to the Parliamentary record, Hansard. The reference to Freemasonry is of interest, but requires further research.

It’s time to put a final end to the bleatings of SNP supporters, Tories, UKIP and anyone else who insists that Labour had anything to do with the creation of the hated Bedroom Tax. This blog article by Rob Gershon shows clearly that the Conservatives intended to restrict housing benefit according to size criteria at that time.

The applicable line is from a speech by David Trippier (then Conservative Parliamentary Under-Secretary of State for the Environment) and was made in a speech on the Water Bill on March 21, 1989. He said: “We do not believe that full Exchequer subsidy should generally be available where a claimant is living in unduly large accommodation.”

He also said: “A tenant who has all or most of his rent met by housing benefit does not, obviously, have the same incentive to bargain with his landlord to keep the rent to a reasonable level as would be the case if he were paying it from his own pocket. We do not believe that the Exchequer, which provides up to 97 per cent direct subsidy on housing benefit, should be expected simply to underwrite any rent that the landlord demands. Therefore, it is essential to have an independent check on the rents being paid from the public purse to ensure that those are not significantly above market level—in other words, above the rents being paid by tenants who are not in receipt of benefit.

“Besides considering claimants’ rents, rent officers will also look at the size of their accommodation.”

One very interesting aspect is the following comment: “Local authorities have long had powers to limit benefit in such circumstances.” If this is true, then it seems to have been optional, with authorities either choosing not to use these powers (on grounds that this may cause undue hardship to the tenant?) or being unaware of them. The imposition of the Bedroom Tax legislation, in such circumstances, would be a matter of forcing local authorities to use these powers, against their better judgement.

Note also that he asserts the Exchequer should not be expected to support any rent demanded by landlords. This applies equally to private landlords and we can therefore conclude that any Conservative who attacks Labour for imposing the Local Housing Allowance rules on private tenants is a hypocrite; Tories introduced these concepts – that landlords should not be allowed to ‘rip off’ the state – and should support them. It’s one of those rare instances in which both parties may agree on a policy point (although for differing reasons, perhaps).

The full comment can also be read here, for those who desire further proof.

The article on ‘Welfare Reform’, with a Bedroom Tax flavour places an interesting emphasis on the role of freemasonry in the creation of the Bedroom Tax – but that is a matter for its author, and not an issue for us at this time. It states: “Contemporary Members of Parliament vie to offload responsibility for the bedroom tax, with coalition MPs wrongly suggesting that the previous government brought it in for Private Tenants. Some commentators wrongly believe that the policy was trialled in 2001, though this is also a grand falsehood.” [Bolding mine.]

It continues: “Behind the apron of respectability, the evolution of this policy has come to be manipulated to blame social housing tenants for the rising rents in that sector, and to suggest that the ever-rising rents of recipients of Housing Benefit in the private rented sector are somehow the fault of tenants. It is tenants, ultimately who are paying the financial price for these prejudices, and thirty years of failed housing policy.

“And so, finally, to the notion that the Labour Government piloted the Bedroom Tax in 2001. It doesn’t seem to matter to those that share it, who stem from the Conservative, Liberal Democrat, SNP and UKIP parties, that no pilot ever took place, and that no such policy was ever introduced.”

Those are the facts of the matter.

Follow me on Twitter: @MidWalesMike

Join the Vox Political Facebook page.

Vox Political needs your help!

If you want to support this site

(but don’t want to give your money to advertisers)

you can make a one-off donation here:

Buy Vox Political books so we can continue

ending malicious falsehoods about hated political policies.

Health Warning: Government! is now available

in either print or eBook format here:

The first collection, Strong Words and Hard Times,

is still available in either print or eBook format here:

Since these last would be the same people who tried to suggest the introduction of the bedroom tax was the end of some equally mythical spare room subsidy, it seems we might fairly assume reality clearly doesn’t often intrude upon their perceptions :-)

The recent ‘Bedroom Tax’ under the Conservative and Liberal Democrat Coalition is simply an EXPANSION of an existing policy. Question: Which government initially put the original legislation through Parliament? Secondary Question: Which party/parties either voted in favour/abstained/ensured all members were absent at the crucial votes? Also, does this mean Labour are committed to reversing ‘Bedroom Tax’ for ALL recipients of housing benefit, even those resident in ‘private rents’? I understand that, historically speaking, its interesting to find out who did what, when. More important we need to have clear information on what the parties are GOING to do in government. Slanging matches just annoy voters, positive policies about how to deal with the future inspire confidence and get more voters to come out!

Your initial statement is correct, as shown in the article. The policy was devised by Conservatives in the 1980s.

Answer one: The Coalition (it seems. I don’t have any information showing that Trippier actually did anything following his statement – perhaps Rob G could help with that?)

Answer two: None of them. I know claims have been made about Labour. They are all false.

Answer three: Silly question. No private tenant is subject to the Bedroom Tax.

This isn’t bedroom tax. This is the reason that you hardly ever got full rent paid when you rented privately. The bedroom tax is in addition to this and WAS devised by labour. The above refers to the actual SIZE (i.e. the square footage) of a property not the amount if bedrooms.

You misconstrue. The Bedroom Tax was devised and implemented by the Conservative-led Coalition Government as part of the Welfare Reform Act 2012. Any discussion about what happened prior to that is on the thinking behind it. Some people said Labour’s Local Housing Allowance was a version of the Bedroom Tax but this has now been completely debunked, as shown in several previous Vox Political articles. Some said that the “under-occupation pilot” study mentioned by Malcolm Wicks was a version of the Bedroom Tax, but examination of what was planned, coupled with the fact that it never took place in any case, torpedoes that. Finally we come to Mr Trippier’s remarks in 1989, in which he stated that the Conservative Party was keen to introduce size criteria for the payment of benefits. It’s not the Bedroom Tax because it wasn’t implemented at the time – but it is clearly what inspired the Bedroom Tax.

I can’t force anyone to accept the evidence but, if you won’t have it, I think that says more about you than the information.

This legislation regarding “Size Criteria” was made about a week after Trippier’s comments referred to in the blog[s]… see Schedule 3:

http://www.legislation.gov.uk/uksi/1989/590/made

That may answer any further doubts regarding government legislation on size criteria & is most definitely Tory.

The *fact* that size criteria legislation has been implemented in the private sector since 1989, is also categorically referenced as fact in this House of Commons Briefing [available as reference to all MPs prior to Bedroom Tax debate], Here page 3, paragraph 2.1:

http://www.parliament.uk/Templates/BriefingPapers/Pages/BPPdfDownload.aspx?bp-id=SN06968

Despite this irrefutable evidence, people still maintain the truth is lies. Why that should be both intrigues and saddens me.

Cheers.

There is also this fascinating document which, again, CLEARLY states everything about the alleged 2001 ‘pilot’.

This document will delight and enthral, I guarantee it… tells all about, and I mean ALL, how Labour viewed ‘underoccupation’ in 2001.

Again, it is an *official* Government report… read it and weep all Labour doubters…

http://webarchive.nationalarchives.gov.uk/20120919132719/www.communities.gov.uk/documents/housing/pdf/138895.pdf

[Its a .pdf file which may want to open in adobe reader or similar, depending on your browser.]

This & other documents [as above] form the basis on which Rob G, Cllr Paul, myself and a few others keep tackling misinformed people on twitter. As I said above, for people, whatever their politics, to deny truth, backed by hard evidence and irrefutable fact is very, very worrying.

Hansard 19 Dec 2001

“Malcolm Wicks: The under-occupation pilot encourages housing benefit recipients living in under- occupied social housing to move to smaller and cheaper accommodation in order to make more efficient use of housing stock. The pilot is expected to run until 2003. Estimated expenditure in 2000–01 was £17,335. This figure is subject to adjustment on receipt of audited claims from participating authorities.”

http://www.publications.parliament.uk/pa/cm200102/cmhansrd/vo011219/text/11219w19.htm

When you’re going to make a counter-claim in respect of something asserted in a popular blog, it helps if you read that blog first. Particularly – in this case – this article:

http://voxpoliticalonline.com/2014/12/30/revealed-labour-did-not-pilot-the-bedroom-tax/

Posting a quote from Hansard is hardly making a Counter claim Mike.

As for popular, I don’t do egotists so slightly less popular now !

You’re right: A quote from Hansard is a factual observation that allows for no further argument.

Carl, in case you don’t see this link above, have a serious read of this…

http://webarchive.nationalarchives.gov.uk/20120919132719/www.communities.gov.uk/documents/housing/pdf/138895.pdf

The TRUTH on how Labour viewed ‘underoccupation’ in 2001. Just the truth.

The link to the Hansard debate shows David Trippier answering a question from Jeremy Corbyn:

“We fully accept that some housing benefit claimants may need a spare room”

Back in 1989 there WAS #CompassionateConservatism

Rob Gershon has been in touch via Twitter to say: “Freemasonry link only because David Trippier was one. I don’t draw any nefarious connections, just bad puns & word jokes.”

Thanks for clarifying that, Rob.

More clarity from Mr Gershon. He says it seems local authorities had their own policies for size criteria before 1989 but this was the first time a national government had tried to standardise them into a single policy.

The Bedroom Tax was invented during the days of the British Empire when the British came to rule Africa, imposing a Hut Tax on tribesmen without a cash economy, and so forcing them to be day labourers on a pittance, just to pay the tax.

In the UK we had hearth taxes, candle taxes and window taxes et al ad nausem throughout our history.

Today the rise from 17.5 to 20 per cent VAT as hit those only getting the 20 per cent poorest income and the 2.6 million pensioners only on lowest state pension of all rich nations and so far, far below the breadline, taking up to half their money according to the Taxpayers Alliance.

But stealth taxes today, including motor, fags and drinks, means the poorest people pay about 90 per cent tax rate, from the 75 per cent of all tax that comes from indirect taxation. To people equally 18 to 100 in age.

Income Tax only brings in 25p in the pound of tax from people to government.

The early retired from the public sector’s massive austerity job cuts, now going to double to more like 2 million, are on average only on works pensions merely

4 per cent lowest income, at a time when even the contribution based works pensions of councils and government are being counted as welfare.

And the non-paid out state pension since 2013 is wrongly being called a surplus since 2013 in the National Insurance Fund, that is ring fenced and full, not having needed a top up from tax for decades, being denied to half over 60s within working poor and the 50 per cent unemployment rate / high unemployment rate of disabled / chronic sick of that age group.

The Tories abolished in 1993, the Labour 1975 law that guaranteed pension payout, that no government has been able to bring back.

This means no government pension has law backing its pay out.

This has meant the flat rate pension is more about NIL STATE PENSION FOR LIFE and LESS NOT MORE of already lowest state pension of all rich nations bar poor Mexico.

https://you.38degrees.org.uk/petitions/state-pension-at-60-now

If Labour told all the losers in the flat rate pension the truth and repealed the Coalition’s Pension Bills 2010-2014, not only would not cost the taxpayer a thing, from the full National Insurance Fund entirely in funds, but would give Labour a majority government of at lest 326 MPs, able to pass into law its help to all ages with ease.

Hilarious.

And of course, there are no members of any other political parties in the Freemasons, along with no Catholics/Jews/Hindus/Buddhists/Muslims etc lol.

You haven’t read the article, then.

While your essential point is correct i.e. that Labour did not introduce the bedroom tax, I think your argument is a bit mixed up.

The quote from the 1989 debate above is from the introduction of the Rent Officers Order into the Housing Benefit scheme for private tenants only.

Rent Officers’ job was to assess properties to establish whether the rent claimed for was above the market rent and also whether the property was unduly large for the claimant’s household. If the RO did find it was too large they were also supposed to decide a notional rent for a property of an adequate size eg if a single person rented a 2 bed house HB would be paid on the RO’s assessment of an equivalent 1 bed property.

There were some further protections for some vulnerable groups (generally referred to as Reg 11) and there were changes to how market rents were decided in 2006, essentially changing from a simple judgment by the RO to a formula. But the key thing is that this NEVER applied to council tenants or, for the most part, HA tenants.

LHA’s introduction again only applied to private tenants and the main change was that maximum figures payable for the size of household anf are were published, meaning tenants could at least know in advance of taking a property what their HB would be. The maximum HB allowed was based on 50% of the max rent in the range of rents for similar properties, Tories cut this to 30%.

The bedroom tax is completely different and is the first time a cut in benefits for ‘over-occupation’ has ever been applied to social tenants. It arguably potentially leaves social tenants worse off than private tenants. If you luck out and find a very cheap private tenancy with an extra bedroom, if the rent is within the LHA limit for your household size and the area the property is in you still get full HB. Admittedly this will be rare but social tenants will always have the Bedroom Tax applied.

So, to sum up, since the Housing Benefit scheme was introduced there has always been an element of ‘bedroom tax’ for private tenants, LHA was just a redesign of how it was worked out. The Bedroom Tax for social tenants is a Coalition introduction. Anybody who says otherwise is either unaware of or wilfully ignoring how previous HB regimes worked.